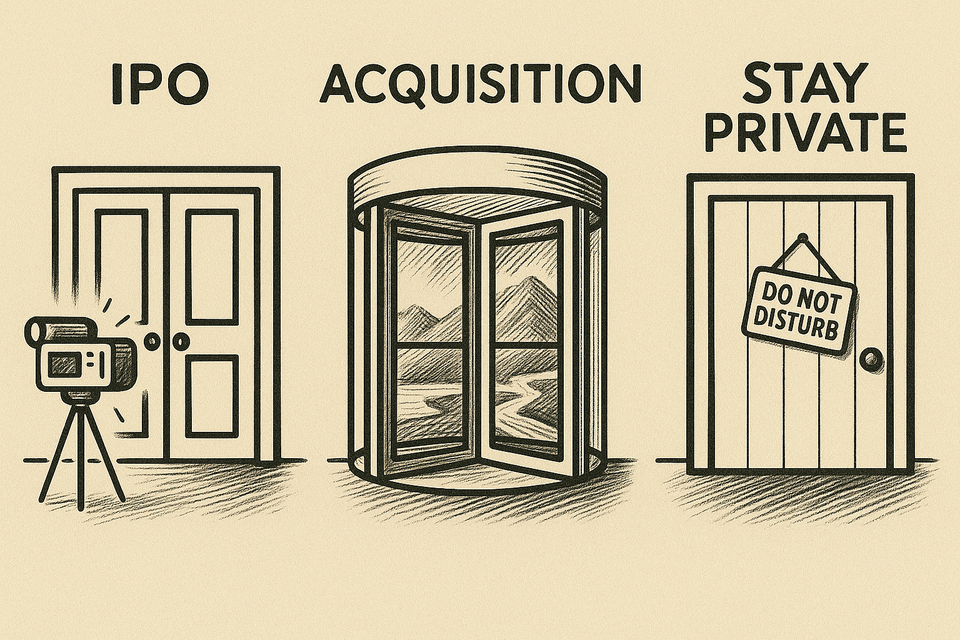

Funding and Exit Strategy - What's the Endgame?

While I had originally planned for this to be a single chapter, the content of each funding and exit strategy ended up being much longer than I expected. Each strategy will instead be its own chapter moving forward so I can give each the attention that it deserves, starting with acquisition target.

Most designers don’t think about funding models or exit strategies when they join a company. We tend to focus on the craft, the product, or the team culture. But lurking underneath all of that is the financial endgame that determines how the company will grow, sustain itself, and eventually deliver returns to its owners or investors.

Why does this matter to designers? These forces shape what gets resourced, which metrics are celebrated, and which corners are cut. They decide whether design is treated as an accelerant to growth, a signal of maturity for acquirers, a function of efficiency, or a long-term brand builder. Understanding the company’s financial trajectory helps you orient your work. It clarifies why certain design decisions are rewarded while others are ignored, why some initiatives are rushed out while others never see daylight, and why definitions of “good design” vary wildly from company to company. As a designer, you don’t need to be an expert in business, but you do need to be literate enough to see the game you’re actually playing.

Each of the following strategies fundamentally changes how design should operate. They should guide how you align design decisions, tactics, and activities with what truly matters to ownership and the business.

- Aquisition target

- IPO

- Growth by acquisition

- Bootstrapped / profit first

- Venture-backed growth

- Private equity ownership

- Nonprofit / mission-driven

- Licensing / OEM model

- Long-term private ownership

- Lifestyle business

- Perpetual independent business

- Cooperative / employee-owned

Acquisition Target

Some companies are built with (or become focused on) the endgame of being acquired. Instead of aiming for long-term profitability or independence, their primary motivation is to become attractive enough that a larger player decides it’s easier to buy them than to compete against them. The incentives can vary: founders may want a payout after years of bootstrapping, investors may want to cash out with a strong return, or the team may believe the product will only reach its full potential once plugged into a bigger ecosystem with more resources.

While strategies for becoming an acquisition target may vary based on broader economic conditions and whatever metrics are in vogue, they often focus on user base size, strategic integrations and partnerships, and market positioning. I'll go into some detail about how things may look different in a slow acquisition market when few deals are being done.

Business Focus

Perceived strategic fit for acquirers. Perceived strategic fit is about designing your company as a whole to feel like it will be easy to integrate with another company. It’s less about chasing acquisition directly and more about making yourself undeniably valuable to the kinds of companies that might one day want to buy you.

Growth in ideal customer profile (ICP) user base.

The goal isn’t just raw user growth; it’s the right user growth. Acquirers want evidence that the company dominates a strategically valuable niche or audience segment that complements their existing portfolio. Effort is concentrated on attracting and retaining high-fit users who make the company’s value proposition look strong and transferable. Metrics like activation rate, engagement depth, and account expansion carry more weight than vanity metrics like downloads or sign-ups.